- About Dover

- Business in Dover

- City Government

- City Services

- Budget Revealed »

- Building Inspection Services Permits and Forms »

- Current Bids »

- DNTV On Demand »

- Election Information »

- Employment »

- Motor Vehicle Registration »

- Parking Violation Payments »

- Online Permits »

- Planning »

- Pay My Bill »

- Public Library »

- Public Welfare »

- Public Safety »

- Recreation »

- Recycling Center »

- Tax Assessment »

- Vital Records »

- Water/Sewer Billing »

- Contact Us

How Local Government Finances Work

Understanding how the city allocates and spends money can be complicated. In addition to the resources available at Budget Revealed, below is an explanation of how the annual budget process works. The City of Dover operates on a fiscal year calendar, which begins July 1.

How It Operates

The City of Dover, like all municipalities, adheres to accounting practices specific to government. The formal process includes recognizing public support for services and infrastructure, as well as following the spending and taxing authority outlined in the budget. There are notable differences between public- and private-sector financial practices, specifically openness and transparency, which are hallmarks of the public sector. Access to regular financial reporting reflects a constructive "spirit of full disclosure" to clearly communicate and educate the public about the financial condition of its government. Dover continues to be recognized for excellence in this area. Governmental accounting standards provide the basis for tracking and reporting financial performance. Public priorities are articulated, debated and ultimately decided by representatives elected to serve on both the School Board and City Council.

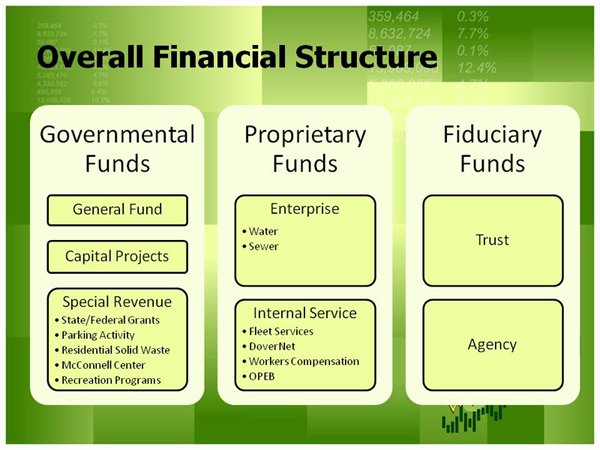

The overall financial structure of the City consists of several separate funds. The following funds fall under the umbrella of

Governmental Funds:

Proprietary Funds:

Fiduciary Funds:

Want to know more? Subscribe to the City's weekly newsletter, Dover Download. Click Here. Our Web Policy | Site Map | Contact the webmaster